A Renaissance Dialogue: Friar Luca Pacioli and Leonardo da Vinci Discuss 12.7% Inflation in Milan

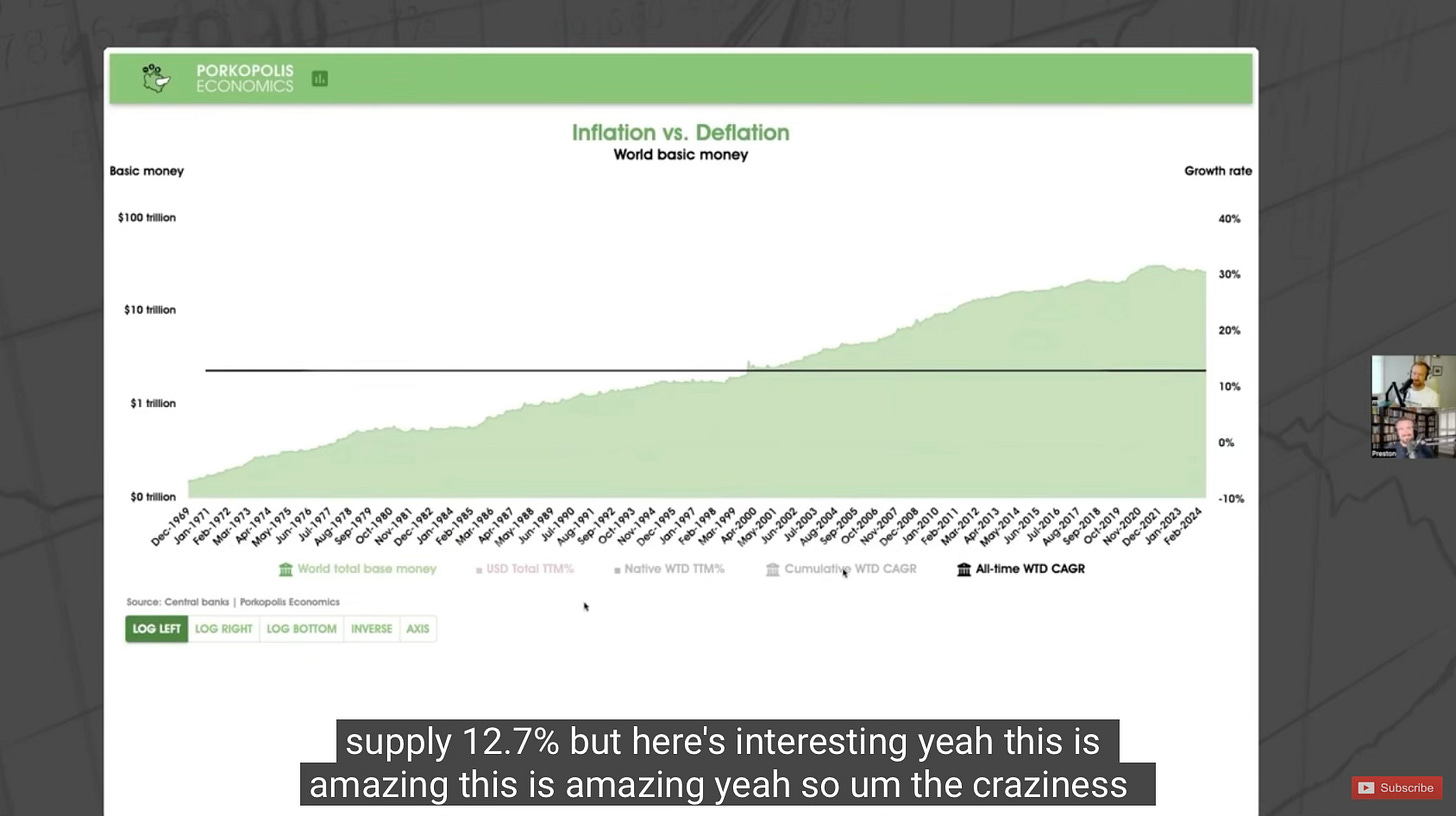

So global base money supply growth is 12.7% per year. That’s the average since 1969 (55 years) according to base money expert Matthew Mezinskis last week.

Base money = physical notes + physical coins + bank reserves

Using the Rule of 72, a 12.7% debasement rate that means buying power is cut in half every 5 years and 8 months.

12.7% inflation rate? 72 divided by 12.7 equals 5.67 years to halve

Intense. Did you know that Franciscan Friar Luca Pacioli introduced the rule to the public in his 1494 treatise Summa de arithmetica, geometria, proportioni et proportionalita?

He presents the rule in a discussion regarding the estimation of the doubling time of an investment. He does not derive or explain the rule, thus we assume that it predates Pacioli by some time.

A voler sapere ogni quantità a tanto per 100 l’anno, in quanti anni sarà tornata doppia tra utile e capitale, tieni per regola 72, a mente, il quale sempre partirai per l’interesse, e quello che ne viene, in tanti anni sarà raddoppiato. Esempio: Quando l’interesse è a 6 per 100 l’anno, dico che si parta 72 per 6; ne vien 12, e in 12 anni sarà raddoppiato il capitale.

Roughly translated:

In wanting to know of any capital, at a given yearly percentage, in how many years it will double adding the interest to the capital, keep as a rule [the number] 72 in mind, which you will always divide by the interest, and what results, in that many years it will be doubled. Example: When the interest is 6 percent per year, I say that one divides 72 by 6; 12 results, and in 12 years the capital will be doubled.

Italiano italiano.

For jokes, I imagined a dialogue between Friar Luca and his friend Leonardo da Vinci about life in Milan were there 12.7% base money inflation. Here’s the resulting tale from a 24-prompt script punchup with my AI assistant.

Enjoy.

A Renaissance Dialogue: Friar Luca Pacioli and Leonardo da Vinci Discuss 12.7% Inflation in Milan

Setting: A Milanese study, 1490s. Friar Luca Pacioli and Leonardo da Vinci are seated, discussing recent economic developments.

Friar Luca: Leonardo, have you heard the latest news from the Milanese mint? They’ve been churning out lire and ducats at a staggering rate.

Leonardo: Indeed, I have. The Duomo artisans are complaining that their wages aren’t buying as much bread as they used to. Yet I’ve heard the gondoliers in Venice don’t have the same complaints.

Friar Luca: It’s a classic case of inflation here not there, Leonardo. The excessive issuance of money is diluting its value in Milan, but not in Venice.

Leonardo: But we’re on the gold standard as they are, aren’t we? Why do our coins fare worse?

Friar Luca: A gold standard is a noble ideal, Leonardo, but even the best intentions can be undermined. It seems the Milanese authorities are adding cheaper metals to their coins, while the Venetian authorities aren’t at all or as much. Perhaps Milan is facing a financial crisis, possibly necessitated by preparations for a war.

Leonardo: Or perhaps they’re simply greedy, seeking to increase their revenue through seigniorage.

Friar Luca: A cynical view, but not entirely without merit. Regardless of the motive, the consequences are clear. Prices are rising, and the common people are bearing the brunt of the burden.

Leonardo: It’s a tragedy. Perhaps we should write a treatise on the dangers of monetary inflation, a cautionary tale for future generations.

Friar Luca: A worthy endeavour, Leonardo. And who knows, perhaps our words will one day influence the policies of those in power.

Leonardo: Or perhaps we could simply reference the work of Nicolas Oresme. His De Moneta provides a comprehensive analysis of the subject.

Friar Luca: Excellent suggestion, Leonardo. How could I forget? Bishop Oresme’s insights were far ahead of his time.

Leonardo: And we could also discuss the Rule of 72.

Friar Luca: Ah, yes, the rule. A simple yet powerful tool for understanding the effects of compounding interest, or in this case, inflation.

Leonardo: Let’s do the math. To estimate the number of years for buying power to halve because of inflation, you simply divide 72 by the inflation rate. For example, if inflation is running at 12.7%, it would take approximately 72 / 12.7 = 5.67 years for prices to double.

Friar Luca: Five years and eight months! A sobering thought. We must convince the authorities to control inflation. Perhaps even halt it, though I doubt it is possible. And speaking of the Rule of 72, I believe I have just the thing! Pulls out a manuscript I’ve been working on a treatise that includes a detailed explanation of the Rule of 72 and its applications. I believe it could be a valuable addition to educate the populace.

Leonardo: That’s wonderful, Friar Luca! I’m eager to read it.

Friar Luca: Wonderful indeed! Yet my excitement is tempered by the circumstances. At the monastery, I see the suffering firsthand. The hungry and the destitute turn to the Church for solace, but even we struggle to provide for their needs.

Leonardo: As an artist, I witness the effects in a different way. The beauty and craftsmanship that go into my paintings are becoming increasingly expensive. The materials, the pigments, even the canvas—all are affected by this inflation. The patrons commissioning my work are pressuring me to cut corners.

Friar Luca: It is a vicious cycle, Leonardo.

Leonardo: Friar Luca, it has been a most enlightening discussion. I am grateful for your insights and wisdom.

Friar Luca: And I, Leonardo, am indebted to your artistic perspective, and your polymathic wisdom. Painter, draughtsman, engineer, scientist, sculptor, architect… Who does that?

Leonardo: Praise be to God and these gifts He has given me. Before we part, allow me to ask, what are your plans for the remainder of the day? I would be honored to accompany you if you are not otherwise engaged.

Friar Luca: I had intended to spend the afternoon tending to the monastery gardens. However, in light of our stimulating conversation, I believe a more contemplative pursuit is in order. Perhaps we could join the monks in the chapel ahead of evening prayers.

Leonardo: That sounds delightful, Friar Luca. I shall meet you there in an hour.

What are bank reserves?

Bank reserves are essentially the bank accounts of banks within a central banking system. In accounting terms, they represent assets held with the central bank and liabilities of the central bank to the individual banks. These reserves facilitate the movement of money between banks and are crucial for the functioning of the banking system. Bank reserves are highly liquid and can be settled in real time, similar to Bitcoin and the Sforza ducats in Milan.

Spread the word

I’ve completed two chapters of a Catholic adaptation of My First Bitcoin’s Diploma, titled “Bitcoin & Catholic Social Teaching.” I’ve contextualized the remarkable course El Salvador has used to graduate 30,000 students using the Bible, the Catechism, and Catholic economic principles. Please send me a message if you’d like free early access.

Hi David, I want access to your course!