Eternal damnation and the S&P 500

I helped a friend invest $500K and found an uncomfortable truth about ETF investing

Last week I helped a friend invest $500,000 that they had sitting in a chequing account after a condo sale. They want to buy a family home in the future, but don’t want to “lose money” investing now. So I recommended the standard Bitcoin advisor portfolio. But then I realized I had to pivot.

Here’s what happened. At the end you’ll find the strategy I now recommend to family and friends.

What most recommend… What I started with

"Most people should invest in the S&P 500.”

“Then a Bitcoin allocation that matches their conviction. Get off zero.”

Why? The S&P 500 is a proxy for money supply growth. Cool. The Fed has to expand monetary supply, so buy the market. No active decisions. You’ll be good, probably. Why does your friend or family member say yes to it? They know they need to make their money “work for them,” and the following selling points comfort an estimated 15-30% of the investing public enough to exclusively invest in S&P 500 ETFs:

Diversification

Historical Performance

Accessibility

Professional Management

Simplicity

You’ve got to match bitcoin position size to conviction, otherwise they’ll sell when downward volatility hits. The stress affects their day-to-day life, their vocation they are pursuing. Then the existing stressors they’re dealing with — alcohol addiction, tight finances, others. A naive me four years ago fresh orange pill learned this the hard way.

So equities and hard money is the strategy, and Catholic Bitcoin owner JD Vance’s portfolio came to mind.

VP Candidate Vance’s portfolio, tweaked

I wrote up a quick draft document explaining VP candidate Vance’s portfolio and why one might want to copy him, then asked my friend how much they want invested.

They remind me they’re really not into logging in and seeing red numbers. They do not understand volatility and it’s not their calling to get it.

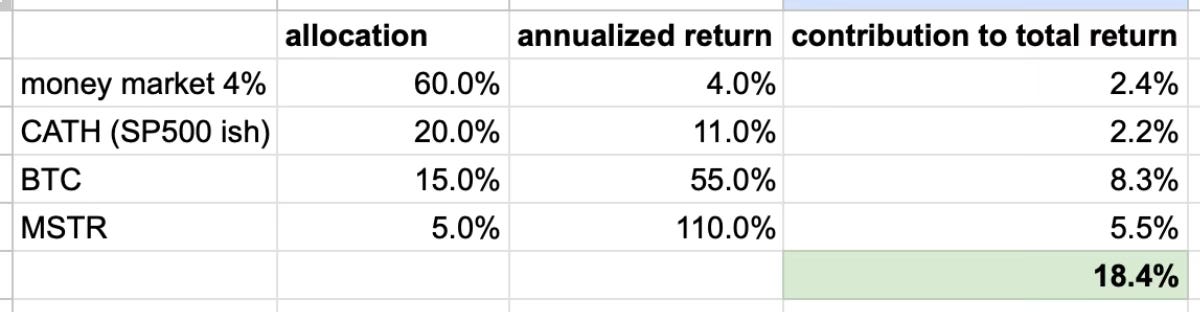

We talk through it and land on 40% invested, 60% money market fund. Coming from 100% money market fund, it’s a step forward. I go back to the JD Vance portfolio, tweak it to remove the gold, then add MicroStrategy (bitcoin ETF-like company I research most).

I go spreadsheet massaging and land on this:

60% money market fund (returns 4% today)

20% some sort of S&P 500 ETF

15% BTC

5% MSTR shares

Lyn’s fav ETFs

I went to Lyn Alden’s website to find the best S&P 500 ETF product. Found this:

I liked the Vanguard S&P 500 ETF (VOO) as well as the iShares competing product (IVV):

IVV and VOO both have slightly lower expense ratios than SPY [note: State Street’s product] but are less liquid, so if you don’t plan on trading any options on them, they are an equal choice compared to SPY and might be better on some platforms due to commission differences.

Cool, VOO it is (but Canadian equivalent product — VFV). 0.09% annual fee is lowest.

I pick my BTC ETF

Fidelity’s FBTC is my pick. Low fees and I liked their vibe on Twitter. Cold storage publicity. Cool. This is the same BTC ETF product VP candidate Vance invests in.

Then… shoot

The next step was to go back to my friend with the ETF products, the allocation percentages, and where to put each in their tax-advantaged vs. non-tax-advantaged accounts.

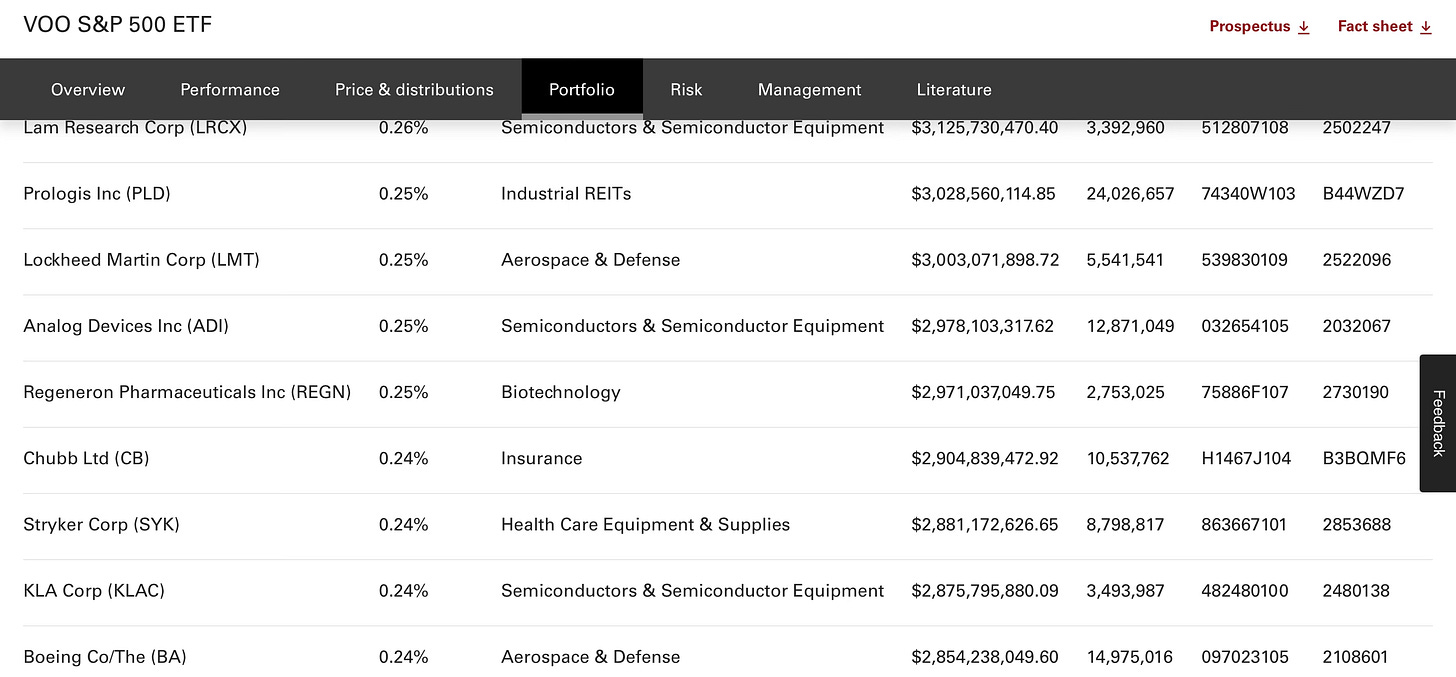

But I found myself looking at the S&P 500 ETF product I chose holds…

WTF is Regeneron?

Last time I thought through this (before my conversion) simply “buying the market” seemed like fine advice. But that’s if you’re only concerned with hard numbers return on investment. But as Catholics, we’re not. We wouldn’t invest in a contraceptives company, for example.

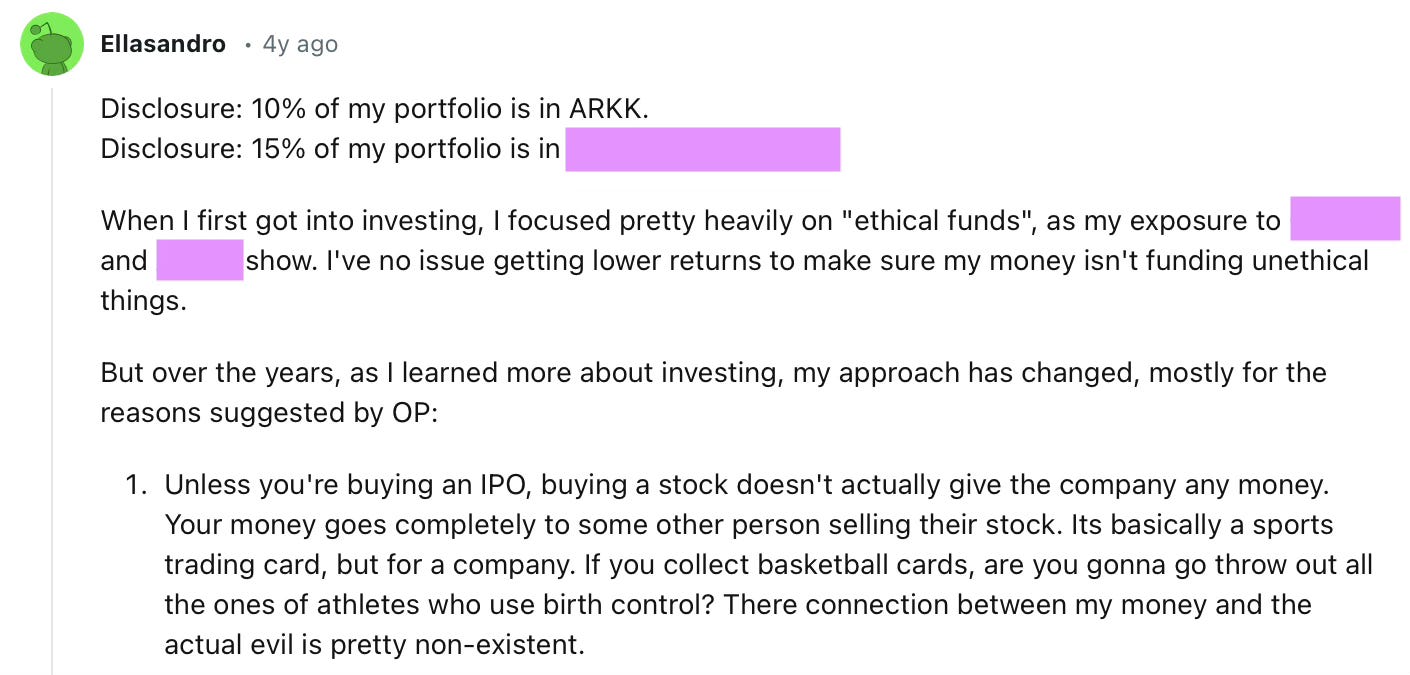

Investing in an ETF doesn’t change that principle. There was a Catholic on Reddit galaxy braining themselves into venial sin:

But that:

is oblivious to how holding shares → supporting company’s market cap → supporting company’s financial strength → company can take loans → company can do more contraceptives biz

Many people aren’t in the weeds finance experts, and that’s okay.

Venial sin is a less serious violation of the moral law than mortal sin. It can occur when one does not observe the standard prescribed by the law, or when one disobeys the law with less than full knowledge or consent.

Then some people argue because it’s hard to avoid supporting immoral behaviour, buying the “broader market” is not objectionable. This argument is better, because even investing in individual companies, you’ll never know for sure the entirety of their operations. (But it still misses how you can just not invest in the broader market, like most of humanity pre-21st century.)

That said, my friend still wanted some of the “normal” way, i.e., an equity ETF.

There’s a decent option

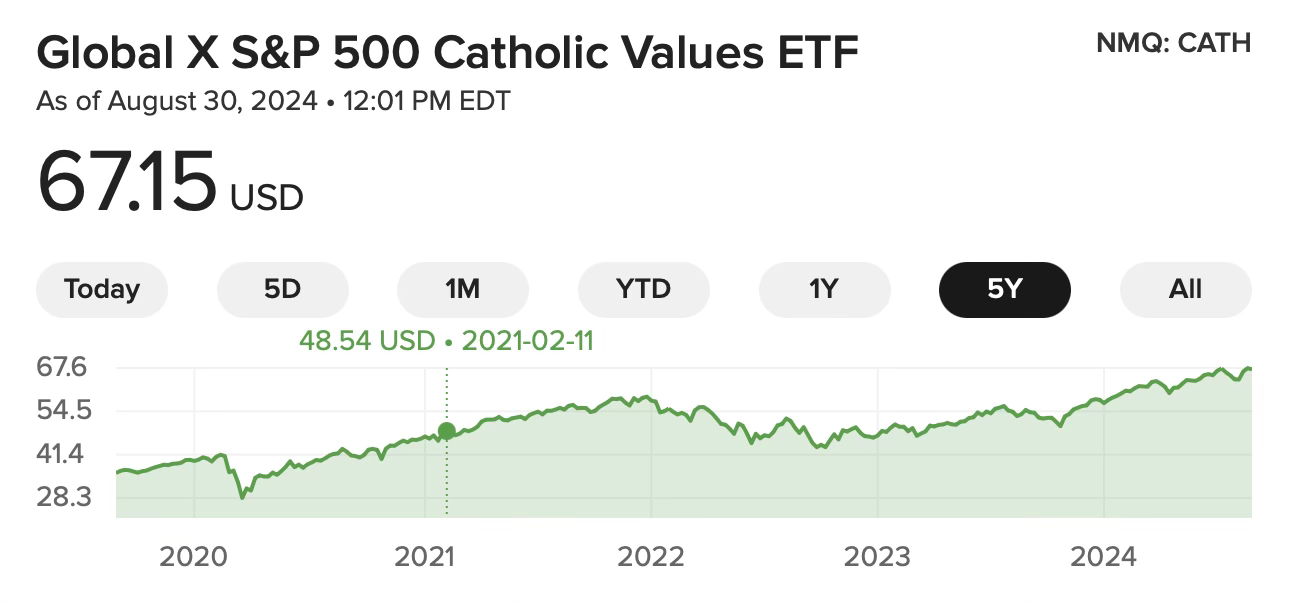

CATH is an ETF from Global X ETFs. For a 0.3% fee, it’s the S&P 500 minus…

Look at CATH ETF. It's a Catholic version of S&P 500 minus abortion, weaponry, contraceptives, etc...

That kicks out Regeneron.

Also, these 68 companies (as of Aug 2024):

Amazon.com: E-commerce giant selling a vast array of products and offering cloud computing services.

Berkshire Hathaway: Diversified holding company with investments in insurance, utilities, and more.

Eli Lilly and Company: Pharmaceutical company known for insulin and other medications.

Walmart Inc.: World's largest retailer by revenue, known for its discount stores.

UnitedHealth Group Incorporated: Largest health insurance company in the U.S.

Johnson & Johnson: Multinational healthcare company with pharmaceuticals, medical devices, and consumer brands.

AbbVie Inc.: Research-based biopharmaceutical company specializing in treatments for immunology and oncology.

The Coca-Cola Company: Beverage company best known for its namesake soft drink.

Merck & Co., Inc.: Pharmaceutical company with a focus on vaccines, oncology, and animal health.

PepsiCo, Inc.: Beverage and snack company with brands like Pepsi, Frito-Lay, and Gatorade.

Thermo Fisher Scientific Inc.: Scientific instrumentation, software, consumables, and services company.

Abbott Laboratories: Healthcare company with products in diagnostics, medical devices, and nutritional products.

Danaher Corporation: Life sciences, environmental, and industrial technology conglomerate.

Philip Morris International Inc.: Leading international tobacco company.

General Electric Company: Diversified technology and industrial conglomerate.

Pfizer Inc.: Pharmaceutical company known for its COVID-19 vaccine and other medications.

RTX Corporation: Aerospace and defense company with a focus on aircraft and engines.

Lockheed Martin Corporation: Leading global security and aerospace company.

Honeywell International Inc.: Leading manufacturer of aerospace products, building technologies, and performance materials.

Vertex Pharmaceuticals Incorporated: Biopharmaceutical company specializing in cystic fibrosis treatments.

Regeneron Pharmaceuticals, Inc.: Biotechnology company with a focus on treatments for cancer and eye diseases.

KKR & Co. Inc.: Global investment firm focused on private equity, credit, and real estate.

The Boeing Company: Leading aerospace manufacturer of commercial airplanes and defense systems.

Bristol-Myers Squibb Company: Pharmaceutical company with medications in oncology, hematology, and immunology.

HCA Healthcare, Inc.: Largest for-profit hospital operator in the U.S.

Mondelez International, Inc.: Snack food company with brands like Cadbury, Nabisco, and Oreo.

Altria Group, Inc.: Leading tobacco product manufacturer with brands like Marlboro and Juul.

General Dynamics Corporation: Aerospace and defense company with a focus on business jets and combat vehicles.

TransDigm Group Incorporated: Aerospace and defense components supplier focused on aircraft systems.

Northrop Grumman Corporation: Aerospace and defense technology company known for military aircraft and spacecraft.

Target Corporation: Discount retailer known for its upscale shopping experience.

Becton, Dickinson and Company: Medical technology company with a focus on diagnostics, life sciences, and surgical instruments.

CrowdStrike Holdings, Inc.: Cloud-delivered cybersecurity platform provider.

GE Vernova Inc.: Industrial technologies company focusing on energy, renewable energy, and power services (formerly part of GE).

L3Harris Technologies, Inc.: Defense electronics and technology company.

Centene Corporation: Managed healthcare company providing Medicaid, Medicare, and commercial insurance.

Agilent Technologies, Inc.: Life sciences and analytical instruments company.

The Hershey Company: Leading North American chocolate and candy manufacturer.

Corning Incorporated: Specialty materials company with products in glass, ceramics, and related technologies.

VICI Properties Inc.: Real estate investment trust (REIT) specializing in healthcare facilities.

Moderna, Inc.: Biotechnology company known for developing and manufacturing mRNA vaccines.

Las Vegas Sands Corp.: International casino and resort operator.

Ventas, Inc.: Real estate investment trust (REIT) specializing in healthcare facilities.

Church & Dwight Co., Inc.: Consumer products company with household brands like Arm & Hammer and Trojan.

GoDaddy Inc.: Domain registrar and web hosting company.

Brown-Forman Corporation: Global beverage company with Jack Daniel's whiskey as its flagship brand.

Leidos Holdings, Inc.: Defense and intelligence solutions company.

The Cooper Companies, Inc.: Medical device company specializing in vision care products.

Alexandria Real Estate Equities: Life science real estate REIT.

Waters Corporation: Scientific instrumentation for chemical analysis.

Jacobs Solutions: Engineering, construction, technology services.

Textron: Aerospace, defense, consumer products.

Everest Group: Management consulting and research.

Universal Health Services: Healthcare provider.

Healthpeak Properties: Healthcare real estate REIT.

Revvity: Life sciences research and development.

Viatris: Global pharmaceutical company.

Celanese: Chemical company specializing in engineered materials.

Eastman Chemical: Specialty chemicals company.

Bio-Techne: Life sciences research products.

MGM Resorts International: Casino and resort operator.

Solventum: Chemical company specializing in specialty solvents.

Huntington Ingalls Industries: Shipbuilding company.

Catalent: Pharmaceutical and biotechnology services.

Ralph Lauren: Fashion designer and retailer.

Charles River Laboratories: Life sciences research services.

Bio-Rad Laboratories: Life sciences research products.

Wynn Resorts: Casino and resort operator.

Caesars Entertainment: Casino and resort operator.

The CATH ETF that excludes these companies returned 38% in 3.5 years. Call it 11% a year annualized. (The S&P 500 returned 12% annualized.)

I’m guilty

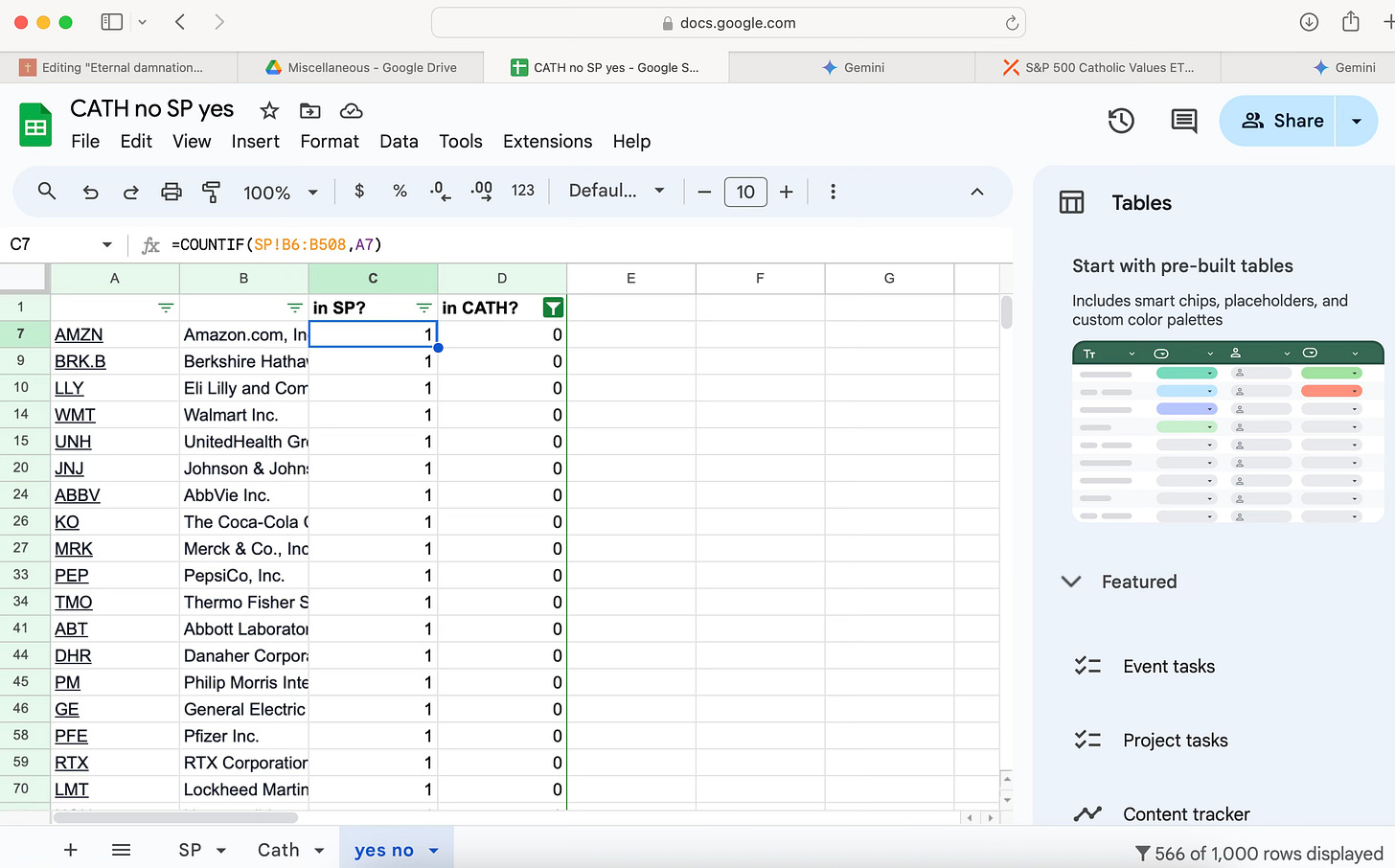

I’ll be honest with you. I’ve only perused the list above. It took me 20 minutes with 10 years of data wrangling experience to hack together this list of “what companies are in S&P 500 but not in CATH.” (The answer isn’t on those Reddit forums and my AI assistant wasn’t helping.)

Do I agree with all the inclusions? I don’t know.

Same thing for the exclusions.

But does it seem better than? Is that enough for prudence to recommend to my friend?

This is exactly how people who feel overwhelmed by the market and therefore buy the entire market itself, perusing Reddit threads for questionable support. We must bring about a bitcoin standard where people can save in the currency they earn.

I go back to my friend and the approve the overall portfolio.

Yes for now

So we’re including CATH. But Ok-Syrup3391 is right:

But until education catches up, folks aren’t gonna do it. Until them, I’m recommending a portfolio like this one to Catholic friends and family:

60% money market fund

20% CATH ETF

15% FBTC ETF

5% MSTR shares

… plus continued friendship to help them hold their keys soon. Backtesting that gives something like 18% annualized.

Not financial advice.

Update

I hosted a dinner with five Catholic friends (1 priest and 4 parishioners) to screen the God Bless Bitcoin followed by Q&A last week to test as a teaching format. It went awesome. Will write about it soon.

I went to my alma mater this weekend for an alumni event and to meet the missionary who I’m funding with BTC. He’s doing a great job.

More soon. God Bless and have a nice week.

“The most catholic investing you can do is Bitcoin, read bout It.” — Ok-Syrup3391