Canada Election 2025: Catholic Central Banker defeats Catholic Bitcoiner

The Catholic social teaching debate of our time few recognized

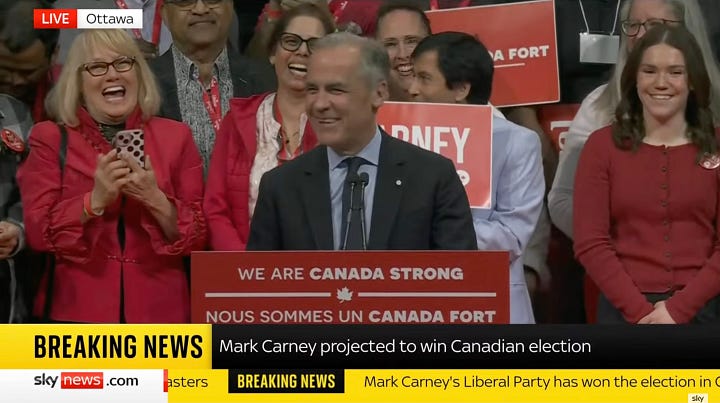

In Canada’s federal election on Monday, Mark Carney—former governor of the Bank of Canada and the Bank of England—defeated Pierre Poilievre, a quiet Bitcoiner. They’re both Catholics, and this election was the Catholic social principles debate of our time that few recognized. The vote centred on inflation: here’s what Carney’s victory means for global cost of living and our Bitcoin education mission.

Two Canadian Catholics

Mark Carney and Pierre Poilievre are both Catholics. Grok tells us about Carney:

Yes, Mark Carney is a practicing Catholic. He was raised in a Catholic family in Edmonton, Alberta, and attended Catholic schools, including St. Rose Catholic Junior High School and St. Francis Xavier High School. His faith has been noted in various sources, with reports indicating he attends Mass regularly, at least once a week, and is influenced by Catholic social teaching, particularly in his economic views. In 2015, while serving as Governor of the Bank of England, he was named Britain’s “most influential Catholic” by The Tablet, a progressive Catholic newspaper. Carney has also been involved with the Vatican’s Steering Committee of the Council for Inclusive Capitalism, reflecting a blend of his faith and economic philosophy.

And about Poilievre:

Yes, Pierre Poilievre was raised Roman Catholic by his adoptive parents, Marlene and Donald Poilievre, and his adoption was facilitated through a Catholic agency in Calgary in 1979. He has publicly identified as a Catholic and occasionally references God in speeches, such as his 2024 Easter message where he referred to Jesus Christ as “Our Lord and Savior.”

Election summary: Carney overcame a big Poilievre lead

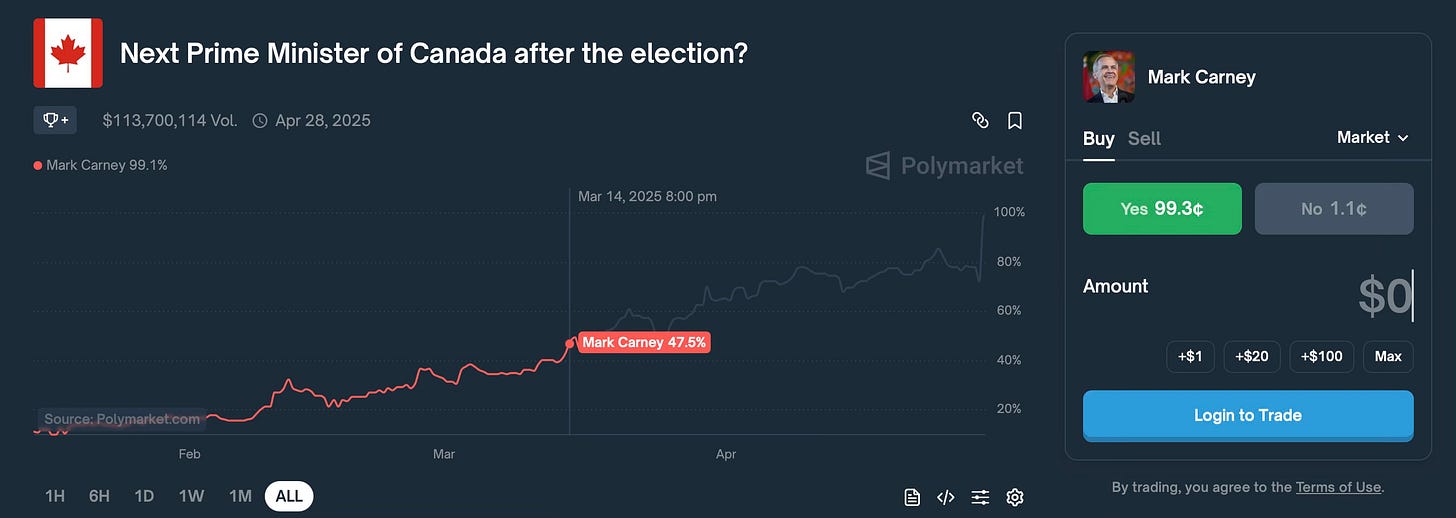

In January 2025, Polymarket gave Poilievre a 92% chance of winning the election—Canadians were fed up with Liberal Justin Trudeau. Carney, stepping in on March 14 as Liberal leader after Trudeau resigned on January 6, overcame the lead steadily and decisively.

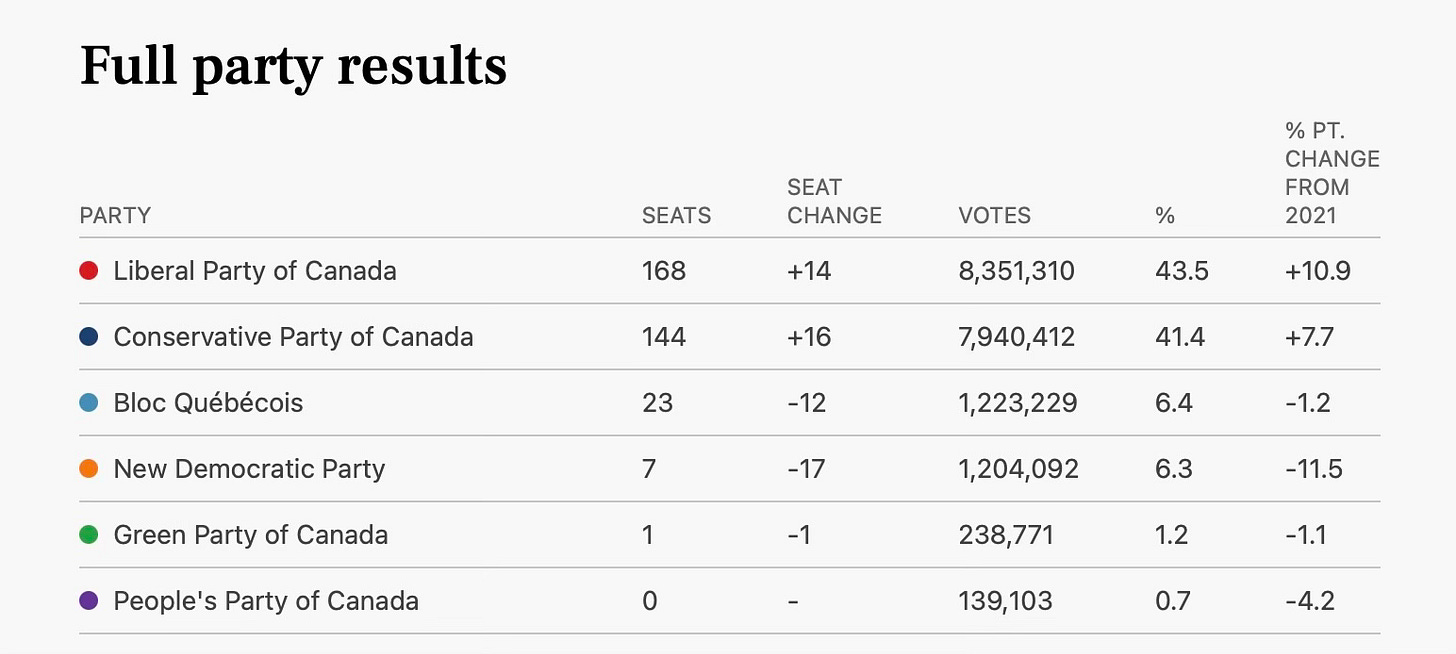

The Liberal Party will form a minority government with Carney’s win.

The big shift was the socialist New Democratic Party losing voters, and the impact of many of them voting Liberal, shifting slightly right on the political spectrum.

Canadians voted about: inflation, Trump

Increasing cost of living was the number one issue for most Canadians, according to polls. President Trump and a U.S. trade war was number two. So the Liberal Party presented Carney as an economics expert with a calm demeanour to handle Trump. Here’s the front page of their plan—it looks conservative:

Grave evils not a focus of the election

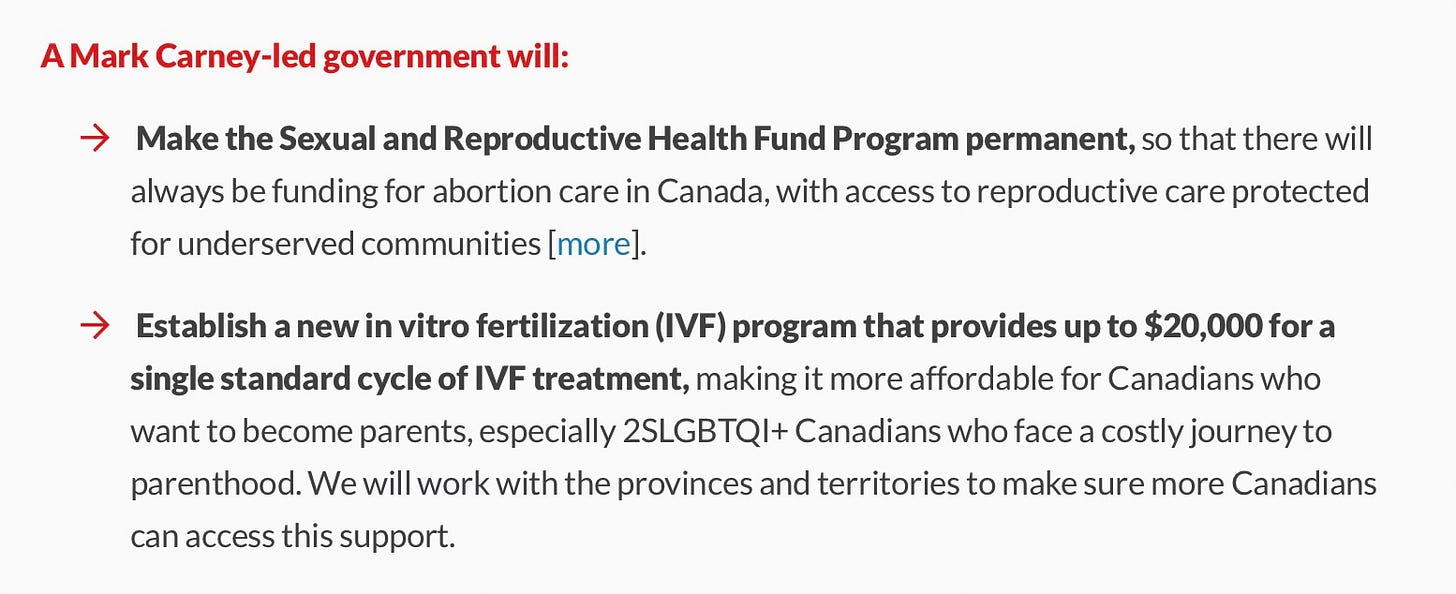

Canada is a secular country, so it isn’t surprising that underneath in the Liberal Party platform we find policies contra-doctrine. Here’s their policy on abortion and IVF:

The Conservatives are against the Church here as well, though less loudly. Their platform is harder to find online, so Grok found it for me:

The Conservative Party of Canada, under Pierre Poilievre, has explicitly stated in its 2025 election platform that it will uphold the status quo on abortion rights. The policy guarantees no restrictions on access to abortion, maintaining the current legal framework where abortion is permitted without legal limits on gestational age, as established following the 1988 R. v. Morgentaler Supreme Court decision…

Overall, Poilievre’s approach seems to be one of minimal engagement, addressing abortion only to clarify the party’s position and quickly pivot to core campaign themes like affordability and public safety.

Brutal. And sadly, not the focus of the election. On a positive note, I believe Bitcoin helps fix this indirectly, so please forgive me if the segue to money again seems insensitive.

Can Prime Minister Carney fix inflation?

Mark Carney’s economic resume is a big part why people voted for him, presumably in the hopes to solve the rising cost of living. Here’s what the populace trusted in, pardon the economic jargon from Grok—we don’t teach this language:

Governor of the Bank of Canada (2008–2013)

Appointment: Carney was appointed the 8th Governor of the Bank of Canada on February 1, 2008, at age 42, one of the youngest in its history, serving until June 1, 2013.

2008 Financial Crisis: Carney’s leadership during the global financial crisis was widely praised. He acted decisively, lowering interest rates by 0.5% in early 2008, ahead of most other central banks. In April 2009, he introduced a “conditional commitment” to keep rates at record lows for at least a year, boosting market confidence and credit conditions… The country was the first G7 nation to recover pre-crisis GDP and employment levels.

Innovative Policies: Carney championed “forward guidance,” a strategy of clearly communicating future interest rate plans to stabilize markets. His actions, including providing substantial liquidity to the financial system, were credited with Canada’s banks outperforming global peers.

Recognition: Carney earned accolades for his crisis management, including being named one of the Financial Times’s “Fifty who will frame the way forward,” Time’s 2010 Time 100, “Central Bank Governor of the Year 2012” by Euromoney, and “Most Trusted Canadian” by Reader’s Digest in 2011.

Then in England:

Governor of the Bank of England (2013–2020)

Brexit and Economic Challenges: Carney guided the UK economy through the 2016 Brexit referendum, a period of significant uncertainty. When the pound sterling plummeted post-referendum, he delivered a televised address reassuring markets of liquidity support, stabilizing financial conditions.

Is this a good set of skills for stopping inflation?

The funding tells the story

Carney’s crisis management largely consists of making debt easier to obtain or to hold. Two main tools he used:

More debt (“providing substantial liquidity”)

Lowering the interest payment on debt (“lowering interest rates”).

The funding of the Liberal Party’s proposed IVF program helps us understand what Carney did in his former life as a central bank governor. Most government programs, including the $20,000 IVF coupon, are funded from one of two main sources:

Tax Revenues: This includes various forms of taxes collected by the government, such as income tax (both individual and corporate), sales taxes, and property taxes. This is generally the largest source of government funding in most developed economies. The source of 90% spending, let’s say, in a typical year.

Borrowing (Government Debt): When tax revenues are insufficient to cover all government expenditures, governments borrow money, from financial institutions approved by the central bank or the central bank itself. Let’s say this is roughly 10% of spending.

Carney spent his previous career creating and managing that 10% debt spending for government. Unfortunately, this debt-spending created long-term inflation. Here’s a real-world example before we go into the simple reason why.

The $5 footlong

Ten years ago, I used to frequent Subway sandwiches to enjoy a footlong meatball sub for $5. Filling, protein-rich, and full of fresh vegetables! Yum!

The original “$5 footlong” promotion in Canada was introduced in 2008. Over time, the $5 footlong deal had to be phased out by individual franchisees at different times between 2011 and 2015, because of rising food costs and labour expenses.

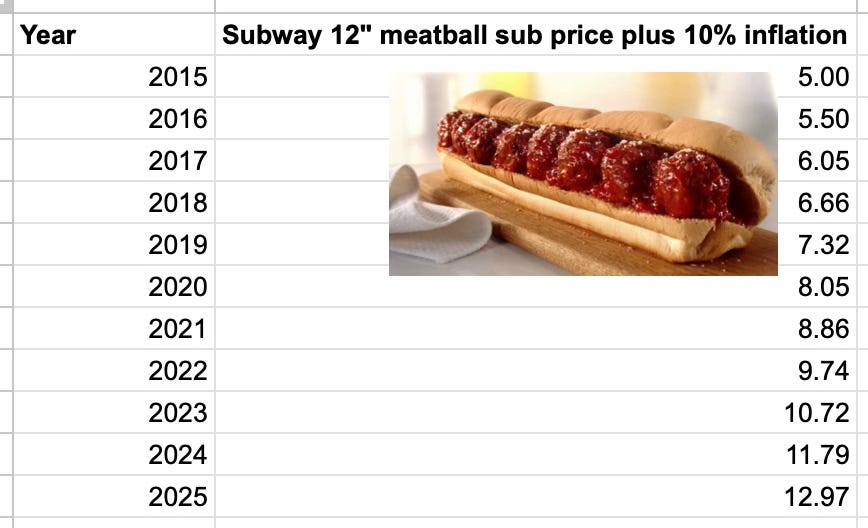

Yesterday, I bought a footlong meatball sub, and it was $14.99 plus tax. If we apply 10% debt spending as our measure of inflation starting from $5 in 2015, we get close to today’s $15 price:

The simple definition of inflation, and how Carney caused it

In Austrian economics, inflation—by definition—is the rate of increase of money supply, which includes new debt. So 10%, for the example above, is our inflation measure. The Central Banks, following Keynesian economics, use a different measure for inflation, and it is typically much lower than the money supply expansion rate. The Catechism demands a stable currency—fiat currencies lose 10% of their value yearly. This is unacceptable.

“Inflation... is an increase in the quantity of money and credit.” —Ludwig von Mises, The Theory of Money and Credit (1912)

Mark Carney as central bank governor making money easier didn’t solve inflation; he caused the cumulative inflation we have today. More, the reason there an economic crisis for Carney to solve was the money and credit creation in first place—an advanced topic solved in the Austrian school. The situation is like a doctor getting their drug addict patient to fix their withdrawal with more heroin. But that doesn’t fix the problem, of course: the pain is pacified with the venom that is the root cause of their pain, bringing more intense pain later.

Poilievre, G7 Bitcoin teacher

The Prime Minister of Canada can’t easily solve the mechanism of debt spending directly because the Central Bank and the government are legally independent. However, they’re practically connected, and Carney’s presence as Prime Minister furthers that connection—he is now in a position to encourage more spending. Inflation will continue to the degree the Liberal government takes on debt. Poilievre’s Bitcoiner mindset would have countered it, hence why his main talking point was cutting government spending.

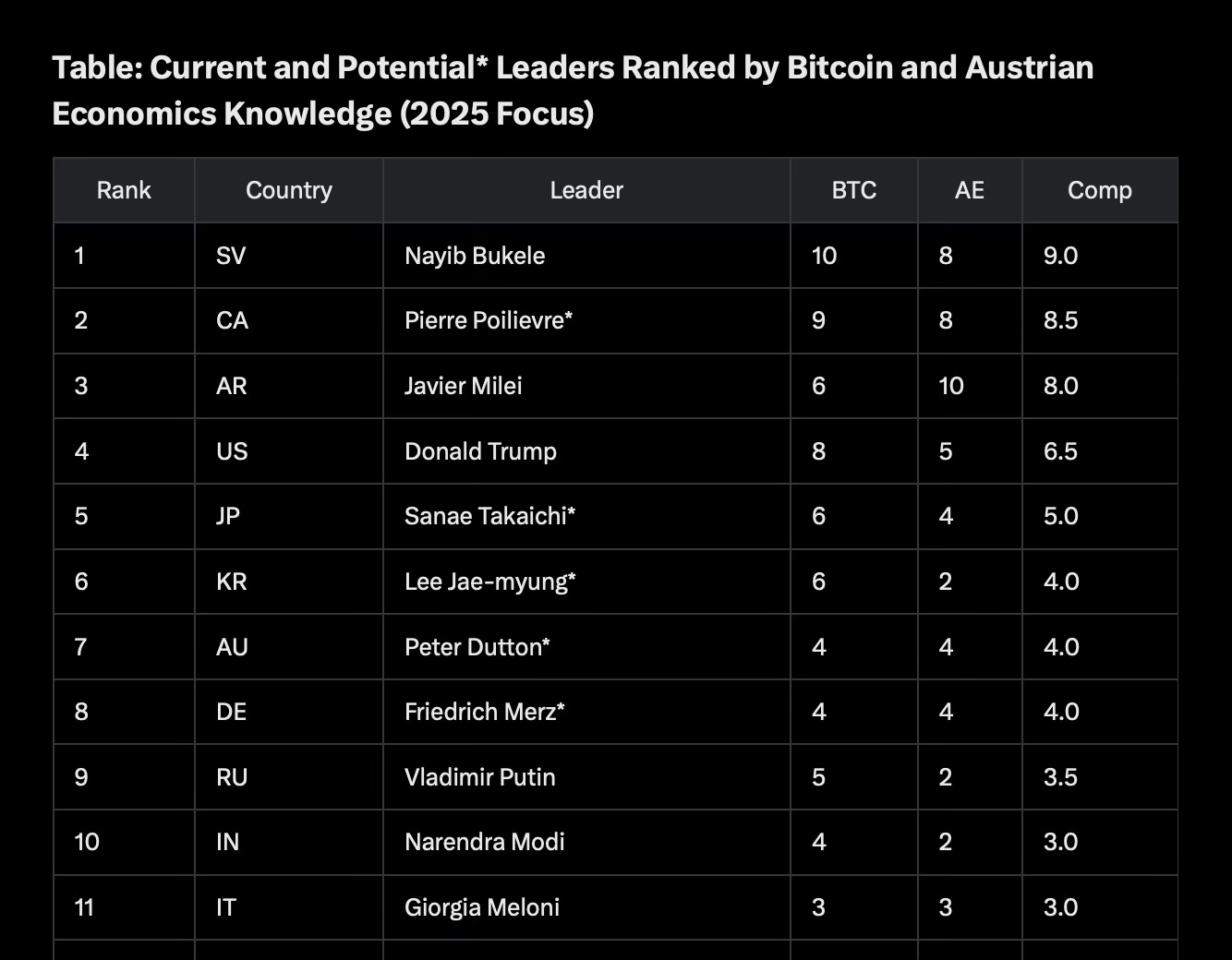

Beyond that, I was hoping (and still hope!) Poilievre would continue teaching Austrian economics and Bitcoin, as he has in the past. Poilievre is one of the world’s most informed politicians on these subjects:

Along with Bukele in El Salvador, he knows that Bitcoin can help stop inflation forever. He also knows one who holds bitcoin is protected from inflation. He chose not to make these truths a part of his campaign—sensible given the state of Bitcoin education demonstrated in the 2022 Conservative leadership debate below.

What this means for NGU Missions

If I were to summarize the story of this election, it’s this:

Canadians think Carney’s policies will fix the economy, but in reality, his presence furthers a systematic issue.

Catholic Austrian economist Jesús Huerta de Soto, whom we met last year, wrote the preface to the 2008 edition of his magnum opus during a global financial crisis. Fellow Catholic Mark Carney was preparing to pacify the pain in Canada at that time. Huerta de Soto wrote:

The above considerations are crucially important and reveal how very relevant this treatise has now become in light of the critical state of the international financial system... Nevertheless, while it is tragic that we have arrived at the current situation, it is even more tragic, if possible, that there exists a widespread lack of understanding regarding the causes of the phenomena that plague us, and especially an atmosphere of confusion and uncertainty prevalent among experts, analysts, and most economic theorists. In this area at least, I can hope the successive editions of this book which are being published all over the world may contribute to the theoretical training of readers, to the intellectual rearmament of new generations, and eventually, to the sorely needed institutional redesign of the entire monetary and financial system of current market economies.

The problem hasn’t been fixed since, but Bitcoin’s invention in 2009 gives us a new system that, while young, is already protecting many from the material and spiritual consequences of inflation. Thus we go forward with our education mission, with a hope that this spiritual work of mercy can alleviate real pain. Don Jesús shares similar to conclude his preface:

If this hope is fulfilled, I will not only view the effort made as worthwhile, but will also deem it a great honor to have contributed, even in a very small way, to movement in the right direction.

Vámonos!